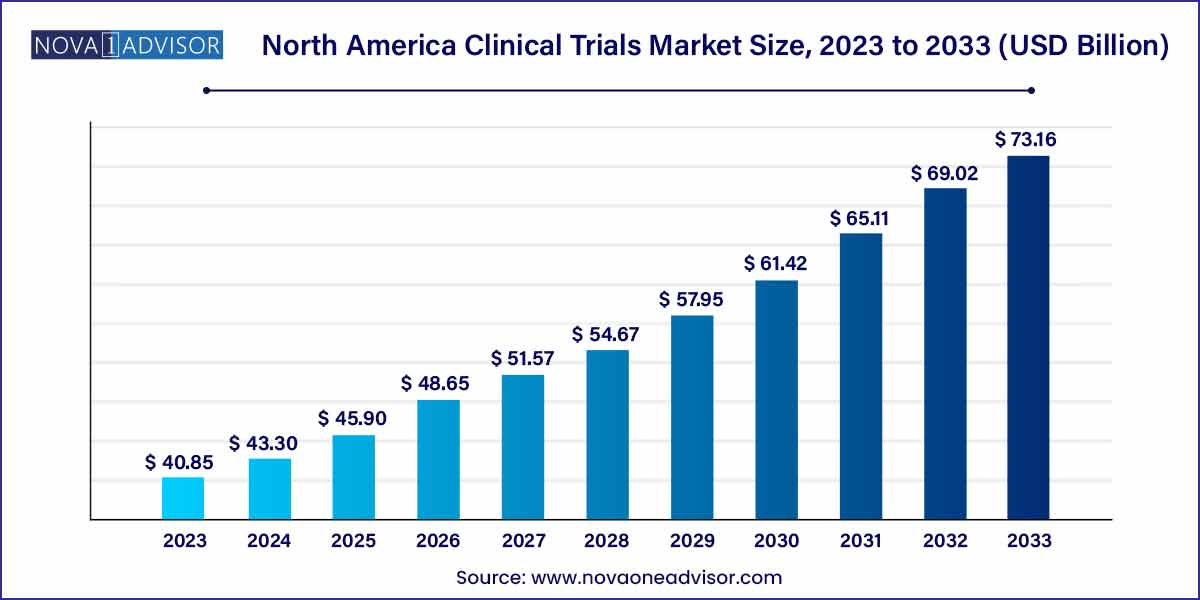

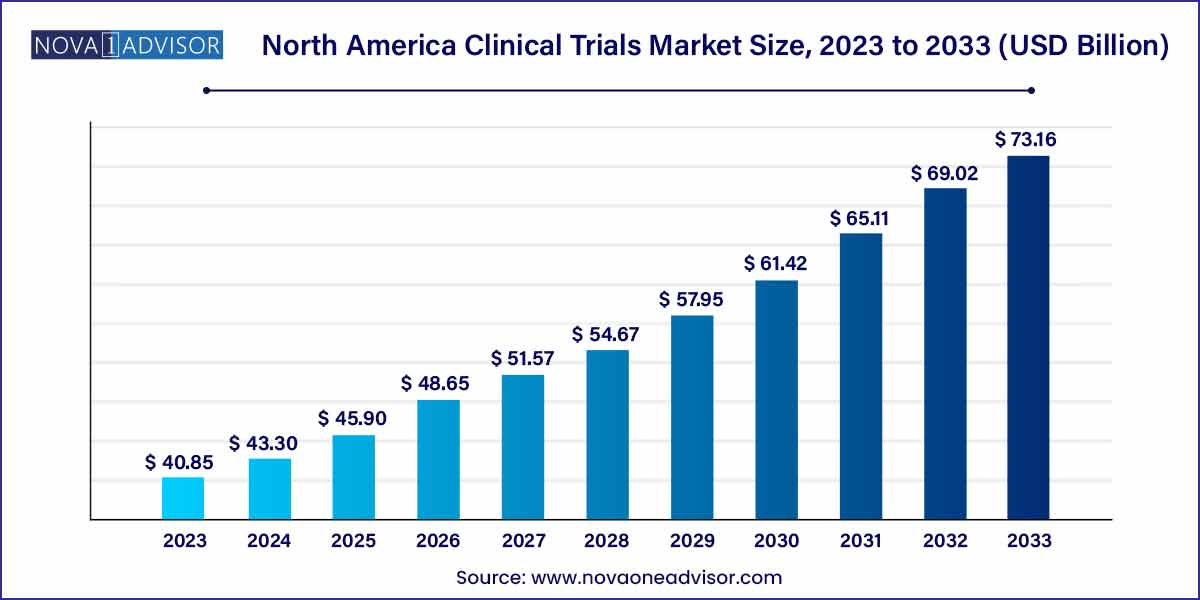

The North America clinical trials market size was estimated at USD 40.85 billion in 2023 and is projected to hit around USD 73.16 billion by 2033, growing at a CAGR of 6% during the forecast period from 2024 to 2033.

Key Takeaways:

- Based on the region, the U.S. accounted for the largest share of the market about 95.9% in 2023.

- Based on the phase type, phase III dominated the market with a revenue share of 53.15% in 2023.

- Based on indication, oncology segment accounted for the largest revenue share of 36.14% in 2023.

- The cardiovascular segment is expected to grow faster at a CAGR of about 5.1% from 2024 to 2033.

- Based on service type, the laboratory services segment dominated the market with a revenue share of 34.77% in 2023.

- Patient recruitment is anticipated to grow at a faster CAGR from 2024 to 2033

- Based on the sponsor, the pharmaceutical & biopharmaceutical companies segment dominated the market with a revenue share of 70.29% in 2023.

- Medical device companies are expected to register a lucrative growth rate from 2024 to 2033

- Based on the study design, the interventional studies segment accounted for the largest share of 83.51% in 2023.

- The observational segment is expected to attain growth with a CAGR of 6.13% from 2024 to 2033.

Market Overview

The North America Clinical Trials Market is one of the most advanced and mature clinical research ecosystems globally. With a strong regulatory framework, world-class research institutions, and leading biopharmaceutical and medical device companies, the region has played a pivotal role in the development of innovative therapeutics and vaccines. Clinical trials form the backbone of the pharmaceutical and biotechnology R&D pipeline, allowing investigators to assess the safety, efficacy, and long-term outcomes of investigational drugs, biologics, and devices before commercialization.

In North America, particularly the United States, clinical trials are not limited to academic and hospital settings. They are increasingly conducted in community centers, retail pharmacies, and even at home through decentralized trial models. Canada also contributes significantly through strong academic-industry partnerships and government funding support for public health trials.

With the demand for precision medicine, rare disease therapies, and immuno-oncology rising, clinical trials in North America are becoming more personalized, data-driven, and patient-centric. Moreover, advances in digital health tools, remote patient monitoring, and electronic data capture systems are transforming the landscape of trial design and execution. North America's leadership in AI-driven trial recruitment and real-world evidence integration ensures it remains a global powerhouse in clinical development.

Major Trends in the Market

-

Rise of Decentralized Clinical Trials (DCTs): Remote monitoring, telemedicine, and eConsent tools are being widely adopted to enhance participation and reduce site dependency.

-

Use of Artificial Intelligence (AI) and Big Data Analytics: AI-powered patient recruitment, trial site optimization, and predictive analytics are enhancing trial efficiency and reducing delays.

-

Patient-Centric Trial Models: Emphasis on participant diversity, convenience, and engagement has reshaped protocol design and site selection.

-

Adaptive Trial Designs: These allow real-time modifications in dosage or patient cohorts based on interim data without compromising statistical integrity.

-

Increased Role of Contract Research Organizations (CROs): Outsourcing of clinical trial services to CROs has grown significantly to ensure speed, scalability, and regulatory compliance.

-

Integration of Real-World Evidence (RWE): Regulators are encouraging the use of post-market RWE to support trial findings and label expansions.

-

Focus on Rare Diseases and Orphan Drug Trials: With policy incentives and unmet medical needs, companies are targeting smaller populations with more complex trial designs.

North America Clinical Trials Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 43.30 Billion |

| Market Size by 2033 |

USD 73.16 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Phase, study design, indication, service type, sponsor, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Covance; IQVIA; Syenos Health; Paraxel International; PRA Healthcare Science; Pharmaceutical Product Development; Charles River Laboratories; Icon; WuXi AppTec; Medpace Holdings |

Key Market Driver: Expanding Biopharmaceutical Pipeline and R&D Spending

A significant driver of the North American clinical trials market is the increasing R&D investments by biopharmaceutical companies, particularly in therapeutic areas such as oncology, autoimmune diseases, and central nervous system (CNS) disorders. The robust drug development pipeline across the U.S. and Canada demands extensive clinical validation before regulatory approvals can be obtained.

In 2024, pharmaceutical R&D spending in the U.S. exceeded $100 billion, with over 6,000 active trials underway. Leading companies like Pfizer, Moderna, Merck, and Amgen are conducting trials across phases to support both new molecular entities and lifecycle management strategies. Additionally, the biotech boom with venture capital flowing into rare diseases, cell and gene therapies, and mRNA-based treatments continues to boost demand for clinical research infrastructure.

The presence of sophisticated clinical trial networks, academic medical centers like the Mayo Clinic and Harvard-affiliated institutions, and a patient population open to research participation contributes significantly to the market's growth trajectory.

Key Market Restraint: Regulatory and Operational Complexities

Despite North America’s strengths, regulatory and operational challenges remain a key restraint in the market. The U.S. Food and Drug Administration (FDA), while globally respected, has strict and evolving requirements that add to development timelines and costs. Protocol amendments, site audits, and complex documentation processes can delay trials, especially for companies with limited resources.

Moreover, patient recruitment and retention remains a significant hurdle. According to studies, nearly 80% of trials in North America fail to meet enrollment timelines. Stringent inclusion criteria, travel burdens, and lack of diversity further complicate participant engagement. In Canada, differences in provincial healthcare systems can create inconsistent access to patient databases and clinical sites.

While digital solutions help streamline some processes, interoperability issues across Electronic Health Records (EHRs) and lack of standardized data models continue to pose bottlenecks in trial coordination and data capture.

Key Market Opportunity: Growth of Precision Medicine and Personalized Trials

An emerging opportunity in the North American clinical trials market is the growth of precision medicine, which relies on targeted therapies tailored to a patient’s genetic, biomarker, or phenotypic profile. The push toward personalization has triggered demand for smaller, biomarker-driven trials that use molecular diagnostics to stratify patients.

Trials for oncology, rare diseases, and neurodegenerative disorders are increasingly employing genomic profiling, next-generation sequencing, and companion diagnostics to identify eligible participants. Companies are adopting basket and umbrella trial designs, allowing for multi-arm investigations within a single protocol maximizing data output and reducing development costs.

The All of Us Research Program in the U.S., led by the NIH, is building one of the most diverse and comprehensive health databases, offering sponsors an unprecedented opportunity to design highly targeted and inclusive trials. These initiatives are poised to reshape how trials are conceived, conducted, and approved across North America.

Segments Insights

By Phase

Phase III dominates the clinical trials landscape in North America. These large-scale studies involve several hundred to thousands of patients and are designed to confirm the efficacy of a treatment, monitor side effects, and compare it to existing standard therapies. Due to the significant investment required, many of these trials are sponsored by large pharmaceutical and biopharmaceutical companies and executed across multiple sites. Phase III trials are also pivotal for FDA approval and commercialization strategies. They account for the highest share of R&D spending and often span therapeutic areas like oncology, diabetes, and cardiovascular disease.

Phase I is the fastest-growing phase, largely due to the boom in early-stage biotech funding and novel therapeutic approaches like cell and gene therapy. Phase I trials involve small cohorts and are primarily focused on safety and dosage exploration. With innovation-driven pipelines expanding, these trials are being conducted more frequently by startups, academic institutions, and early-stage biotech firms. In the U.S., accelerated approval pathways have also encouraged more exploratory trials, including adaptive Phase I/II studies.

By Study Design

Interventional studies dominate, as they form the core of therapeutic validation. These studies involve actively assigning participants to interventions such as new drugs or procedures and observing the outcomes. The clear structure and regulatory backing for interventional designs make them the default in most clinical development programs. North America is a leader in randomized controlled trials (RCTs), considered the gold standard for medical evidence.

Expanded access studies are gaining momentum, particularly for terminally ill patients or those with no alternative treatment options. With the Right to Try Act passed in the U.S., investigational drugs can be accessed outside of trials, often leading to parallel expanded access studies. These programs are especially relevant in oncology and rare diseases and are expected to grow further as patient advocacy groups demand faster access to promising therapies.

By Indication

Oncology dominates the North American clinical trials market, reflecting the high prevalence of cancer, significant unmet medical need, and massive pharmaceutical investment. Trials for immunotherapies, targeted therapies, and combination regimens are common. The U.S. alone hosts thousands of active oncology trials, often involving biomarker testing and genomic profiling.

CNS conditions are the fastest-growing indication, particularly Alzheimer’s disease, multiple sclerosis, and epilepsy. With increasing awareness and the aging population, pharmaceutical firms are investing in next-generation neurotherapeutics. Clinical trials in CNS diseases are complex due to long follow-up durations and subjective endpoints but offer substantial rewards in terms of market potential.

By Service Type

Laboratory services dominate, especially for biomarker validation, blood work, and centralized testing. These services are critical for trial integrity and regulatory compliance. Leading labs like Labcorp and Quest Diagnostics offer specialized clinical trial divisions that support pharmacokinetic and pharmacodynamic assessments.

Patient recruitment services are growing rapidly, as sponsors struggle to meet enrollment targets. AI-driven matching platforms, EHR mining, and social media recruitment strategies are now used to connect trials with eligible participants. As diversity mandates increase, companies are also engaging community clinics and advocacy groups to reach underrepresented populations.

Pharmaceutical and biopharmaceutical companies dominate the sponsorship landscape, accounting for the vast majority of trials. These companies lead in innovation, often running multi-phase, multi-site studies across indications. They rely heavily on outsourcing for trial execution, especially to CROs like ICON and IQVIA.

Medical device companies are seeing faster growth, particularly in diagnostics, digital health solutions, and implantable technologies. The rise of digital therapeutics and software-as-a-medical-device (SaMD) platforms has opened new avenues for device-centric clinical validation. In the U.S., the FDA’s Digital Health Software Precertification Program is facilitating faster device trial approvals.

Country-Level Analysis

United States

The United States is the largest and most influential market for clinical trials globally. Home to the FDA, NIH, and the largest number of academic medical centers, the U.S. sets the gold standard for regulatory compliance, patient access, and trial design. Companies benefit from robust intellectual property protections, early access to diverse patient populations, and well-defined pathways for new drug approval. The country’s healthcare digitization and payer ecosystem also support real-world data integration and post-market surveillance.

Canada

Canada plays a critical complementary role, known for its high-quality clinical research infrastructure, strong ethics review systems, and cost-effective trial execution. The country attracts multinational trials through favorable tax incentives, bilingual populations, and a highly educated medical workforce. Moreover, Canadian regulatory bodies have aligned many trial approval processes with the U.S. to streamline cross-border collaborations. Canada's emphasis on public health research and Indigenous health studies also offers unique opportunities for therapeutic research.

Recent Developments

-

April 2025 – Pfizer and BioNTech launched a new Phase III trial for their mRNA-based influenza vaccine in over 50 U.S. clinical sites.

-

March 2025 – IQVIA announced the expansion of its decentralized trial services across rural Canada in partnership with local community hospitals.

-

February 2025 – Moderna received fast-track designation from the FDA for a personalized cancer vaccine, initiating Phase II trials in North America.

-

January 2025 – Labcorp Drug Development unveiled a new AI platform to streamline site feasibility studies, reducing trial setup time by 30%.

-

December 2024 – ICON plc acquired a leading digital health CRO in Canada to enhance hybrid and virtual trial offerings across oncology and cardiology.

Key North America Clinical Trials Company Insights

Some of the prominent players operating in the North America clinical trials market include IQVIA, PAREXEL International Corporation, and Charles River Laboratories International, Inc. These companies provide services companies in clinical trials, personalize patient engagement, and navigate regulatory hurdles, ultimately aiming to bring lifesaving treatments to improve patient outcomes.

Key North America Clinical Trials Companies:

- Covance

- IQVIA

- Syenos Health

- Paraxel International

- PRA Healthcare Science

- Pharmaceutical Product Development

- Icon

- Charles River Laboratories International, Inc.

- WuXi AppTec

- Medpace Holdings

- Pharmaceutical Product Development (Thermo Fisher Scientific)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America Clinical Trials market.

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional Studies

- Observational Studies

- Expanded Access Studies

By Indication

- Autoimmune/ Inflammation

- Pain Management

- Oncology

- CNS Conditions

- Diabetes

- Obesity

- Cardiovascular

- Others

By Service Type

- Protocol Designing

- Site Identification

- Patient Recruitment

- Laboratory Services

- Bioanalytical Testing Services

- Clinical Trial Data Management Services

- Others

By Sponsor

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

By Regional

- North America

- U.S.

- Canada